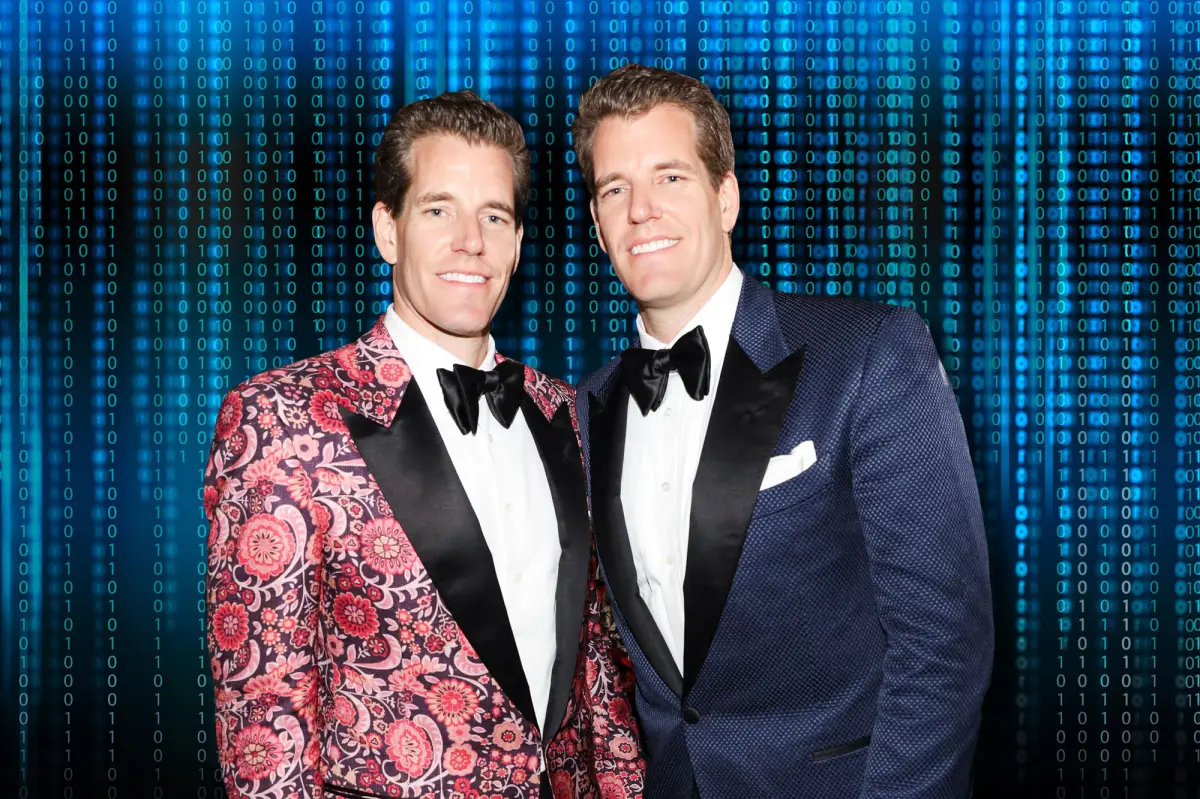

Cameron and Tyler Winklevoss, famously known as the Winklevoss twins, are two of the most recognizable faces in the world of cryptocurrency. Their journey from Harvard-educated athletes embroiled in a legal battle with Facebook’s Mark Zuckerberg to visionary Bitcoin investors and crypto exchange founders is a testament to their tenacity and foresight. Today, they stand as two of the largest holders of Bitcoin, with an estimated 70,000 BTC in their portfolio, valued in the billions. Their story is a fascinating mix of legal drama, calculated risks, and entrepreneurial success.

The Facebook Lawsuit: Turning Setbacks Into Opportunity

The Winklevoss twins first gained public attention in the mid-2000s, but not for Bitcoin or blockchain. At the time, they were better known for their role in the early days of Facebook. While still students at Harvard, the twins came up with an idea for a social network called ConnectU, and they hired fellow student Mark Zuckerberg to help with coding and development. As the story goes, Zuckerberg allegedly used the twins’ idea to create Facebook, leading to a lawsuit that would become one of the most talked-about legal battles in Silicon Valley.

In 2008, after a long legal struggle, the Winklevoss twins were awarded a $65 million settlement from Facebook. Many might have seen this as the end of their journey, a bitter-sweet conclusion to a battle they never wanted to fight. But for the twins, this settlement wasn’t the finish line—it was the starting point of something much bigger.

While others may have invested their newfound fortune in traditional stocks or real estate, the Winklevoss brothers saw potential in an emerging digital asset: Bitcoin.

A Bold Bet on Bitcoin

In 2012, Tyler and Cameron Winklevoss made the kind of bold move that only those with true vision could pull off. They took a significant portion of their Facebook settlement—rumored to be in the tens of millions—and invested it in Bitcoin. At the time, Bitcoin was still very much in its infancy, often dismissed by mainstream investors as nothing more than a speculative bubble.

But the Winklevoss twins weren’t deterred. They believed in the underlying technology, understanding that Bitcoin’s decentralized, digital nature had the potential to disrupt traditional financial systems. They began accumulating large amounts of Bitcoin when it was still trading in the low double digits.

Their bet would soon pay off in ways even they couldn’t have predicted. As Bitcoin’s value soared over the next several years, the twins’ investment multiplied exponentially. By some estimates, they purchased approximately 70,000 Bitcoinduring their early foray into the cryptocurrency space. At Bitcoin’s peak price, their holdings were worth billions of dollars, making the Winklevoss twins among the first Bitcoin billionaires in history.

Building the Gemini Empire

The Winklevoss twins didn’t stop at being early adopters of Bitcoin. In fact, they quickly recognized that for Bitcoin to go mainstream, it would need a secure and regulated platform for buying, selling, and storing cryptocurrencies. This realization led to the founding of Gemini in 2014, a cryptocurrency exchange that prioritizes regulation and security—two critical factors that were missing from many early crypto platforms.

Gemini was designed with the goal of bringing legitimacy and trust to the volatile and, at times, chaotic world of cryptocurrency trading. By focusing on compliance with U.S. financial regulations, Gemini was able to establish itself as a trusted exchange for both retail and institutional investors. The exchange’s name, “Gemini,” reflects the twins’ vision of a twin pairing: traditional finance and digital assets coexisting in a new financial ecosystem.

Under the leadership of Tyler (CEO) and Cameron (President), Gemini grew rapidly. It became known not only for its high-security standards but also for its user-friendly interface and innovative products. In addition to traditional cryptocurrency trading, Gemini also introduced Gemini Earn, which allows users to earn interest on their crypto holdings, and Gemini Dollar (GUSD), a stablecoin pegged to the U.S. dollar.

Through Gemini, the Winklevoss twins have not only secured their own positions in the world of crypto finance but also helped foster broader adoption of cryptocurrencies across the financial industry.

Political Engagement and the Contribution to Trump

The Winklevoss twins’ influence stretches beyond the world of finance and cryptocurrency. In recent years, they have become more politically active, recognizing that the future of blockchain technology and cryptocurrencies may be shaped by government regulations and policies.

In 2021, Tyler and Cameron Winklevoss made headlines for their substantial contribution to former President Donald Trump’s campaign. The twins donated 30.94 Bitcoin—15.47 BTC each—worth approximately $2 million at the time. However, part of their contribution was eventually refunded, as it exceeded the legal limit for campaign donations.

This move, though controversial to some, demonstrated the growing intersection of cryptocurrency and politics. As Bitcoin and other digital assets gain mainstream acceptance, their role in political donations and influence is likely to increase, and the Winklevoss twins were early participants in this trend.

The Winklevoss Vision: Bitcoin as the Future of Money

For the Winklevoss twins, Bitcoin isn’t just an investment—it’s a revolution. Over the years, they have spoken extensively about their belief in Bitcoin’s potential to become the world’s primary form of money, challenging the dominance of fiat currencies like the U.S. dollar.

They often compare Bitcoin to gold, describing it as “digital gold” due to its limited supply (only 21 million will ever be mined) and its ability to serve as a store of value. In fact, the twins have publicly stated that they believe Bitcoin could eventually reach a value of $500,000 per coin, making it a more valuable asset than gold.

Their bullish stance on Bitcoin has drawn both admiration and skepticism. While some see them as visionaries, others question whether Bitcoin can truly replace traditional currencies or if it will remain a speculative asset. Regardless, the Winklevoss twins have consistently positioned themselves as champions of the cryptocurrency movement, advocating for a future where decentralized digital currencies play a central role in the global economy.

Beyond Bitcoin: Diversifying Their Crypto Holdings

Although the Winklevoss twins are most closely associated with Bitcoin, they have diversified their investments into other areas of the cryptocurrency space as well. They have expressed interest in Ethereum, the second-largest cryptocurrency by market capitalization, and have backed various blockchain projects through Winklevoss Capital, their venture capital firm.

Winklevoss Capital focuses on funding projects that contribute to the growth of the decentralized internet, or Web 3.0. This includes investments in startups building decentralized applications (dApps), blockchain infrastructure, and other cutting-edge technologies that support the future of the internet. Their broad portfolio underscores their commitment to not just cryptocurrency, but the larger potential of blockchain technology to disrupt various industries.

Challenges and Criticism

While the Winklevoss twins have achieved incredible success, their journey has not been without challenges. The cryptocurrency market is notoriously volatile, and the twins have experienced major fluctuations in their net worth as Bitcoin’s price has soared and crashed over the years.

In addition, their foray into the political realm and their advocacy for cryptocurrency regulations have drawn criticism from some members of the crypto community who fear that overregulation could stifle innovation. However, the twins maintain that regulation is essential for crypto to reach its full potential, and that a regulated environment will encourage broader adoption among institutional investors.

Legacy in the Making

Today, the Winklevoss twins stand as pioneers in the cryptocurrency space, not just for their early investment in Bitcoin but for their continued efforts to make cryptocurrency accessible to the masses. With their leadership at Gemini, their advocacy for Bitcoin, and their diverse investments in blockchain technology, Tyler and Cameron Winklevoss have cemented their legacy as two of the most influential figures in the digital economy.

Their story is one of vision, resilience, and the ability to turn a legal setback into an opportunity that has reshaped the financial landscape. The Winklevoss twins’ journey from Harvard rowers to crypto billionaires serves as a powerful reminder of the unpredictable nature of success—and the transformative potential of betting big on the future.

Whether Bitcoin reaches their ambitious prediction of $500,000 or not, the Winklevoss twins will undoubtedly continue to play a central role in the evolving world of cryptocurrency. As the industry matures, so too will their influence, ensuring that their names remain synonymous with the rise of digital finance.

With 70,000 BTC and counting, the Winklevoss twins have secured their place in crypto history—visionaries who saw the future of money before most people even knew what Bitcoin was.

Leave a Reply